It’s been a good long while, I know, and I apologize. But life has become a bit insane, with travel, client work, and of course, writing a 90-page report on the truth about Millennials as real estate consumers. The February Red Dot just went live today, so I can finally write this post I’ve been sitting on for a while.

I’ll provide a brief overview of some of my findings about the future of real estate consumers, but really want to get into a topic that wasn’t directly on-point for the report, and yet is important to put out there and discuss.

The thesis is this: Millennials are far more divided than any generation before them. The gap between the Elites and the Non-Elites is just staggering, and on dimensions we have never seen before as a country and as a society. And the crisis of the Millennial generation cannot be separated from the crisis in housing.

It is now clear (to me at least) that housing affordability will be the single biggest issue for the next generation of consumers.

All levels of organized real estate, from NAR on down to the local, have hitherto been on the side of homeowners. Protecting property rights often meant protecting property values, which also coincides with protecting REALTOR income, which is directly tied to high home prices. It has worked for decades, when the American economy and society were different, and the American Dream invariably centered around homeownership.

Today, Millennial homeownership is 8% lower than it was for GenX and Boomers. Given the changes they are confronting, homeownership may never even break the 50% mark. And that has enormous consequences for all of us. REALTOR politics has to change if it is to avoid becoming a politics of, for, and by the Elite.

That is what the YPN must do: change organized real estate to better address the issues of the consumer of the future. This is what justifies the existence of YPN at all. If the new leadership coming out of YPN does not embrace this challenge, then all we have are old heads on young bodies, old ideas in younger brains, and the same old words on younger lips. Then we must conclude that YPN is nothing more than a social club for young people paid for by their parents’ generation. That will not do.

Let’s get into it.

A Brief Overview of the Truth About Millennials

Obviously, I would encourage you to purchase the February Red Dot for the full report and analysis with charts and data and links and such. That’s basic Sales & Marketing 101. But I’ll try to summarize the main points here for our discussion about YPN because at least high level context would be better than none, and I’m not trying to sell more reports, but to engage in real conversation about a real topic.

The real estate industry’s view of Millennials is actually a view of the Elite Millennials: well-educated, urban, sophisticated, with high income and wealth, often with elite parents who can help them out financially. The stereotypes about Millennials, that they are spoiled, entitled, impatient products of the participation trophy generation are just that: stereotypes. The truth is that most Millennials are living lives of insecurity, paranoia, and uncertainty. They’re caught in a downward spiral. Many of them can’t see a way to break out of that negative cycle.

If you need a great overview of how the non-Elites see the world, take a look at FML, a multi-media experience article over at Huffington Post’s Highline. FML, by the way for those not hip to the youth jargon, stands for Fuck My Life. And the thesis could be said to be this paragraph right here:

Contrary to the cliché, the vast majority of millennials did not go to college, do not work as baristas and cannot lean on their parents for help. Every stereotype of our generation applies only to the tiniest, richest, whitest sliver of young people. And the circumstances we live in are more dire than most people realize. [Emphasis added]

Elite Millennials will be fine, and in fact, have better prospects than previous generations. They are more educated than previous generations, and make more money than previous generations (at least, if they’re married with a child). Sure, they put off major milestones like marriage, having kids, and buying a house… but they’ll get there eventually like their parents and grandparents ahead of them.

Non-Elite Millennials, however, face a very different set of prospects. From the writer of FML:

What is different about us as individuals compared to previous generations is minor. What is different about the world around us is profound. Salaries have stagnated and entire sectors have cratered. At the same time, the cost of every prerequisite of a secure existence—education, housing and health care—has inflated into the stratosphere. From job security to the social safety net, all the structures that insulate us from ruin are eroding. And the opportunities leading to a middle-class life—the ones that boomers lucked into—are being lifted out of our reach. Add it all up and it’s no surprise that we’re the first generation in modern history to end up poorer than our parents.

This is why the touchstone experience of millennials, the thing that truly defines us, is not helicopter parenting or unpaid internships or Pokémon Go. It is uncertainty.

Anxiety defines the consumer of the future. And when they realize that they are victims of a world whose rules have changed, and they will not achieve even what their parents have, that anxiety gets replaced by frustration, hopelessness, and rage.

Here’s what I wrote in the February Red Dot:

The majority of Millennials (and therefore the majority of the consumers of the future) are caught in a downward spiral of economic headwinds and social dysfunction. For every hotshot 24 year old data scientist at Google, there are literally thousands of young people whose lives look nothing like success.

Lack of education, and in some cases the lack of an Elite education (advanced degrees, Ivy League schools, etc.), leads to unemployment or underemployment.

But the student loans racked up to get an education puts even more of a financial burden on them. They’re forced to rent, and often in high-rent cities where the jobs are located.

Because of their poor economic prospects, they do not get married, which then reduces both their desire to become homeowners and their ability to do so.

All of those problems get so much worse for those Millennials who never went to college. The structural changes to the economy means that the value of physical labor has fallen dramatically, and automation is starting to do the same for low-level service jobs.

And that gap between the Elites and Non-Elites is growing. Housing is a big piece of that puzzle.

(Marriage is the other big piece of that puzzle, but I may have to deal with that in a different post. Suffice to say that lack of marriage is the number one reason why homeownership is suppressed among Millennials, so let’s keep it about housing for now.)

Housing and Wealth

It should be no surprise to any working REALTOR anywhere that housing is the path to financial security. The industry is constantly telling people to build their own equity, not the landlord’s equity.

But some studies by economists suggest that the link goes way beyond just paying off one’s mortgage versus paying rent to a landlord. CityLab summarizes some of the findings, particularly from a National Bureau of Economic Research working paper, on the link between housing and growing inequality:

Economic inequality is one of the most significant issues facing cities and entire nations today. But a mounting body of research suggests that housing inequality may well be the biggest contributor to our economic divides.

After summarizing the research (do read the whole article, and even the study discussed), CityLab continues:

All this forms a fundamental contradiction in the housing market. Housing is at once a basic mode of shelter and a form of investment. As this basic necessity has been transformed over time into a financial instrument and source of wealth, not only has housing inequality increased, but housing inequality has become a major contributor to—if not the major overall factor in—wealth inequality. When you consider the fact that what is a necessity for everyone has been turned into a financial instrument for a select few, this is no surprise.

The rise in housing inequality brings us face to face with a central paradox of today’s increasingly urbanized form of capitalism. The clustering of talent, industry, investment, and other economic assets in small parts of cities and metropolitan areas is at once the main engine of economic growth and the biggest driver of inequality. The ability to buy and own housing, much more than income or any other source of wealth, is a significant factor in the growing divides between the economy’s winners and losers.

So homeowners benefited enormously from rising home prices, while renters did not. And some homeowners benefited far more than other homeowners, because their homes rose in value far faster than other homes for a variety of reasons. And as we in the industry all know, once you get on the homeowner track, it’s far easier to stay on the homeowner track, as you can use the equity in your old house to buy a new house. That’s the whole point of a starter home: buy a small, less expensive home, live there for a few years, climb the job ladder, sell it and use the equity to buy your next larger home. And repeat.

The trouble is getting on that homeowner track in the first place.

Housing and Millennials

It isn’t as if Millennials are completely ignorant of what’s been going on. FML has a whole section on housing and how it has caused the crisis of inequality among Millennials themselves. Here’s a passage from FML that should be a wakeup call to everyone in real estate:

[Rent while saving up for a down payment, buy a starter home, then move up to a larger place and raise a family] worked well when rents were low enough to save and homes were cheap enough to buy. In one of the most infuriating conversations I had for this article, my father breezily informed me that he bought his first house at 29. It was 1973, he had just moved to Seattle and his job as a university professor paid him (adjusted for inflation) around $76,000 a year. The house cost $124,000 — again, in today’s dollars. I am six years older now than my dad was then. I earn less than he did and the median home price in Seattle is around $730,000. My father’s first house cost him 20 months of his salary. My first house will cost more than 10 years of mine.

Which prompts the question: How did housing in America become so freaking expensive?

The answer, at least for the author of FML, is politics:

That’s because all the urgency to build comes from people who need somewhere to live. But all the political power is held by people who already own homes.

For homeowners, there’s no such thing as a housing crisis.

Why?

Because when property values go up, so does their net worth. They have every reason to block new construction.

He talks about the impact of zoning, of environmental regulations, and other political constraints to affordable homeownership. He knows what’s up and what’s been going on. They all know, because they’re highly educated.

And many, many of them are pissed off:

And so the real reason millennials can’t seem to achieve the adulthood our parents envisioned for us is that we’re trying to succeed within a system that no longer makes any sense. Homeownership and migration have been pitched to us as gateways to prosperity because, back when the boomers grew up, they were. But now, the rules have changed and we’re left playing a game that is impossible to win.

We start earning less money, later. We have more debt and higher rent.

Which means we aren’t able to save.

Which means we can’t buy a house or prepare for retirement.

Which means that unless something changes…All of us are headed for a very dark place.

REALTOR Politics Today Are On the Side of the Elites

Which brings us to REALTOR politics, since organized real estate has been engaged in the business of politics from the very start. You could say that it is the raison d’etre of the REALTOR Association at all three levels: local, state and national. Political advocacy is in the Preamble to the Code of Ethics, the founding ideals of the REALTOR movement.

And just about every week, you can find some REALTOR or another posting on Facebook and Twitter and Instagram that they’re off to some committee meeting somewhere to “protect homeownership” or “fight for homeowners”. There are constant calls to contribute to RPAC to fight for homeownership.

Here’s the thing: if homeownership is increasingly reserved for the Elites, then REALTOR politics is on the side of the Elites.

That should be concerning to all of us who work in and around the real estate industry. From the Red Dot:

The Non-Elites are filled with insecurity and rage. If you read through the FML article, you know that virtually every paragraph is filled with contempt and rage for the world these non-Elites find themselves in, which they did not create.

From a real estate perspective, if homeownership is increasingly for the Elites, then real estate is on the side of the Elites.

When REALTOR Associations oppose things like rent control (for all kinds of good economic reasons), the political perception from the non-Elites will naturally be that the real estate industry is of the rich and for the rich. They have trouble making rent payments on their jobs at Quizno’s; are they really going to listen to a defense of private property rights from a bunch of luxury-car driving REALTORS?

And as the writer of FML says, “The crisis of our generation cannot be separated from the crisis of affordable housing.”

This tension is a central and fundamental conflict in the world of organized real estate. Because you cannot have both the homeowners and the future home buyers be winners. You cannot have home prices continue to rise well past inflation and wage growth, and also have homeownership within reach for the growing numbers of Non-Elites.

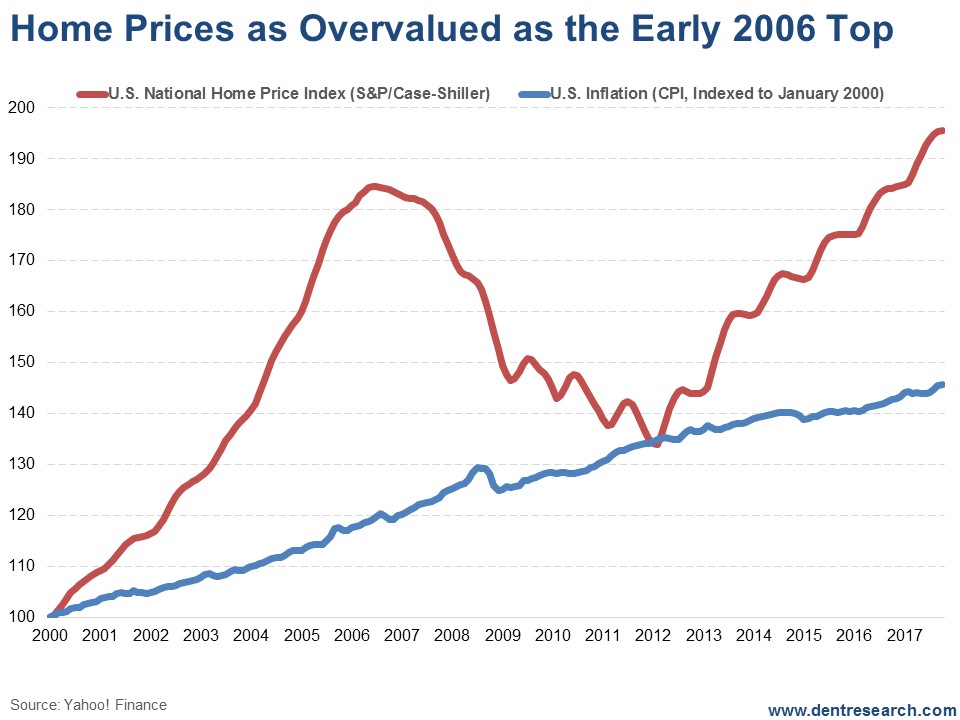

Note that 2012, the depth of the housing collapse, was the last time that home price index was at or below inflation. NAR has done a great deal of work, with a great deal of success, in lobbying for greater access to mortgages for buyers, but easier loans do not drop the price of homes.

To be fair, REALTORS have also argued for removing barriers to new construction, from irrational zoning codes to NIMBYism. A great many real estate professionals and organizations are concerned about and working on affordable housing.

But real estate as an industry has never resolved the conflict at the heart of the problem: in order to make housing more affordable, home values have to drop and drop quite a lot.

If home values drop, that hurts homeowners. There’s no question about it. It also hurts REALTORS, as their incomes are based on commission.

Yet… the alternative is the end of homeownership for all but the minority of Elites and the rise of renter nation… which then results in a new political order where housing is no longer the “third rail of American politics.”

And yes, NAR is a powerful force in American politics, partially because of the enormous amounts of money it spends on lobbying and on campaign contributions, and partially because of the 1.3 million REALTOR members it has. But let’s be clear about this: another reason, and possibly the major reason, for the power of the housing lobby led by NAR is that 75% of Boomers and 60.4% of Gen-Xers are homeowners. Only 42% of Millennials are today, and given the divide between the Elites and Non-Elites, and the economic uncertainty that surrounds all but a minority of the younger generation, it is far from clear that Millennials will cross the 50% homeownership threshold.

All political bets are off if 55% of Millennials and Gen-Z are renters, y’all. Because they’re not just the consumers of the future, but also the voters of the future.

So, YPN…

Which brings us to my original question/mission for YPN. I know many of the pioneers of the YPN movement. Some of the elder statesmen are some of my closest friends in the industry whom I respect enormously for their professionalism, dedication to the ideals of the REALTOR movement, and vision and leadership.

The initial energy behind YPN came from frustration, as younger REALTORS were being told to “wait your turn” in order to serve in leadership positions. But they didn’t want to wait and many thought they couldn’t afford to wait as the older generations who didn’t understand technology, didn’t understand the massive changes in the industry brought on by the internet, and didn’t understand the changing consumer culture kept making decisions they felt were hurting the Association, hurting the MLS, hurting the industry, and frankly, hurting their businesses as real estate professionals.

The original YPN wanted a seat at the table, so that they can help guide the industry in directions it needed to go.

The official Mission Statement of the YPN, as per NAR, which embraced the movement as a way to get younger members more involved in the Association, says:

YPN helps young real estate professionals excel in their careers by giving them the tools and

encouragement to become involved in four core areas:

- REALTOR® associations. Attend REALTOR® conferences and pursue leadership roles with their local, state, and national associations.

- Real estate industry. Take an active role in policy discussions and advocacy issues; be informed about the latest industry news and trends.

- Peers. Network and learn from one another by attending events, participating in online communication, and seeking out mentoring opportunities.

- Community. Become exceptional members of their community by demonstrating a high level of REALTOR® professionalism and volunteering for causes they feel passionate about.

YPN members have been very successful in pursuing and getting leadership roles with their local, state and national associations. Elizabeth Mendenhall, President of NAR in 2018, was one of the OGs of YPN. Some of the other leaders at all levels of REALTOR Associations are or came out of YPN:

- Brian Copeland, 2019 Vice President of Association Affairs and a member of the NAR Leadership Team

- Dale Chumbley, 2019 President of Washington REALTORS

- Nina Dosanjh, 2019 President of San Francisco Association of REALTORS

And dozens of others besides these three are in or climbing into REALTOR leadership ranks. If the time isn’t now, then it is right soon.

A few years ago, before Mendenhall became the President of NAR, I recall asking her, “So what changes once you YPN guys take power? Is there anything substantive that you guys would do differently than the old people who are in leadership now?”

I now have an answer to my own question: YPN should be, must be, the group that puts housing affordability front and center of the agenda across the real estate industry.

The next generation of leaders must address the issues of the next generation of consumers whose main concerns are not flood insurance or availability of loans or net neutrality but affordable housing. The YPN must slant REALTOR politics away from homeowners to home buyers and potential home buyers, even if that means advocating policies that result in drops in home values and REALTOR commissions.

This Is Why You Exist At All

Many of the YPN leaders are Elite Millennials themselves, with the income, the financial security, married with a family, homeownership, and the lifestyle that the Elites have, do now, and will enjoy. It’s hard to take time to do things like volunteer and donate to RPAC if you’re worried about making rent and having enough money for groceries.

But not all of the members (or potential members) are the Elites. Real estate is a difficult enough business to get into, never mind succeed in. Becoming a REALTOR is not getting a job, but a starting up a small business. For far too many Millennials, that’s out of reach.

For sure, the vast majority of future consumers are not Elites.

Homeownership is not under attack; if anything, homeownership is widely subsidized and supported, in large part because of REALTOR political action. Think about it. Mortgage interest deduction alone is a giant gift to homeowners. What is under attack is becoming a homeowner, at least for the younger generation.

Let’s not kid ourselves — this is going to be hard. You’re going to have to convince us GenX and older folks, both consumers and REALTORS, that this is a step we have to take. Whatever the ideas are that y’all come up with, they have to drop the price of homes to a level where the average Millennial can afford to even dream about ownership one day. Just telling them they can take out larger and larger loans when they have the largest student debt load ever is not going to do the trick, y’all. So that’s going to be a tough slog. We know this. You should know this going into it.

But go into it you must.

This is the YPN’s generational challenge. It is what justifies changing the rules so that younger people can have a seat at the table in the first place. Boomers and GenX didn’t give up their turn at leadership, their chance on committees and on boards, so that younger heads can think the same old thoughts they would have, younger voices say the same old words they would have, and younger hands do the exact same damn thing they would have. If younger leaders were going to be clones of older leaders, then you know what? They could have waited their turn like everybody else did.

It is what justifies the time and the expense and the effort. The typical 54-year old female REALTOR did not have her dues dollars spent on your networking events and parties at NAR so that you could have a good time. They tolerated having their own organization do 30 Under 30 spreads celebrating youth, without doing 70 over 70 celebrating wisdom, because they knew that one day, you would step up to the challenges of younger consumers.

We all tolerated the special treatment you received because we figured that future problems require future leaders. Well, the future problems are here today, and YPN is in leadership positions to do something about them.

So if you end up doing nothing about them… what was the point of all of this?

This issue at this moment is why you exist at all, YPN. It’s time to step up and Own It!

Because we all might need you to save us from what’s coming otherwise.

If the industry’s future leaders do not step up and accept this mission, then rest assured that outsiders will. They might be political demagogues who take advantage of the frustration and rage of the younger Have-Nots who vastly outnumber the Elite Haves, or they might be giant corporations who see a way to profit from the rise of Renter Nation.

Sure, we have put you under the pressure of walking in our shoes. And every step that you take might be another mistake to us. And yes, you might end up failing too. But know that we were just like you with someone disappointed in us.

Be a little more like you and a little less like us… for all of our sakes.

-rsh

13 thoughts on “A Mission for YPN, If You Choose to Accept It…”

A great great article by a person who we all might need more people like him.

I agree with this beautiful article. Very true! The current system in the real estate industry failed to protect our kids dream to own a house. The American dream became to be a nightmare for millions of the younger generation.

I can speak in behalf of my four kids.

The Millennials, for most of them to save for a down payment to buy a house is only a dream, it is not doable unless your parents are rich.If I look on this entire sad picture, I can blame the government who the only way they could save the economy in the U.S after giving all the jobs to our Chinese pals, was to lower interest rates and basically giving free money to banks.Lower interest rate creates demand and we all know what happens to prices when there is a high demand.

From raising home prices, counties make more money from property tax, you need to borrow more money from the banks who make more money, down-payment tripled, rents tripled, and those who created this big mess is in a big party, completely drunks.

Very interesting, and I see a lot of that around (and inside me as one of the non-elite). One thing I don’t see mentioned, though, is that all the talk of “affordable” housing is for properties between $200,000 and $400,000. When did $200k become affordable, let alone $400k? Especially as incomes are still at 1980/1990’s levels.

TIL about YPN. Emailed link to a successful 25 yr. old Realtor I know personally. Took 2 seconds. I encourage others to do the same.

Thank you for addressing the elephant in the real estate room. In my opinion, home affordability is the number one pressing issue — more so than technology. I’m an oldie, so I have seen first-hand in the trenches after 2012 Millennial home buyers dropping out of the home-buying race because home prices were too high. Like you say, good for homeowners, but not for those trying to get in on the ground floor of the homeowner track.

It may be time to take a look at community banking. Before anyone starts screaming socialism the idea is worth looking at. Of course, commercial banks won’t like it and sure they will do everything in their lobbying power to put the kibosh on it. Public or community banking is local and it could be a possible solution to appease both sides. The Bank of North Dakota, the only state-run bank in the United States established in 1919, was able to weather the last financial crisis. There is currently a grassroots movement in California and other states for public banking, which could provide low-cost loans with minimal interest to the people. Just a thought.

Excellent and stinging article. As the parent of a millennial I see in my personal life what the author of FML is speaking of. I hope you are able to bring this subject to light as the whirlwind of REALTOR events occurs in 2019. Championing a commitment for affordable housing is worthy of their generation. Thanks for the good read Rob!

Man, when you hit it on the head, you crush it. Great article, and like you said “Here’s the thing: if homeownership is increasingly reserved for the Elites, then REALTOR politics is on the side of the Elites.”

The trend of believing not only do we represent the 1% but that many of us ARE the 1% has been evident since the last recession.

Of course, views like this are drummed out of conversations in NAR committees and policy. Too liberal, too progressive and IMHO too disruptive to an old guard that treats millennial and Gen Xers as though they are still their kids.

Your suggestion to YPN is a very heavy lift, especially since so many of the early out YPN leaders in major metro areas are living or aspiring to live in that sliver of millennial heaven reserved for the elite in that group. Well said and well done.

The Millennials should also blame the massive Inequality on the old men at the Federal Reserve for keeping interest rates at near Zero and then other old men borrowed money for nothing and bought everything in sight. That raised prices and lowered the owner-occupancy rate to new lows. Millennials should also blame the creatures created by the FED including Blackstone Group, the Flippers and the Top 10% who had access to cheap money and displaced the first-time buyers starting in 2012-13. And don’t forget the Chinese, other foreigners, High-Tech workers and other All-Cash buyers that helped create the asset bubbles that ignored true value. The Millennials just got farther behind every year. History tells us this will not end well for the Elite if the Millennial vote gets organized. There will be a Bastille Day or the Rise of Socialism. Unbridled Capitalism will be it’s own demise.

ROB,

One of your best!

Here’s a thought. There’s data that suggests that we are just at the beginning of the largest transfer of wealth in history – “The finding suggests a “vast generational transfer of wealth” is “just beginning,” said George Walper Jr, president of the Spectrem Group, which conducted the study”.

I wonder how many of those non-elites will be a part of this distribution? It may be something that should be considered in the conversation as this “new money” could be used to pay-off student loan debt and if there is some left-over a small down payment on a home….

#theremaybemoremoneyaroundthanwethink

Just a thought (or hope).

Thanks,

Brian

https://www.straitstimes.com/world/united-states/super-rich-americans-are-getting-younger-and-multiplying-survey

Such a great article, Rob! As a single, non-elite millennial myself, I feel this pain every day while I work in the the real estate tech industry and I appreciate you surfacing the topic. I’m 33, have a great job, and have wanted nothing more than to own my home. But I’m in a rat race. My city is too expensive and I can’t save fast enough. I could afford to put 3-5% down in my pathetic price range, but that leaves approximately 7 houses in the boonies for me to choose from at any given time. (And, oh boy, are they special). My salary puts me out of the running for affordable housing through city programs, yet I couldn’t afford the “affordable” houses in the program! I’m starting to consider marriage with a more formal, business-oriented approach just so I can have a roof over my head when I’m 65 and our social security program has run dry.

OMG. This comment wins the entire comment section, as far as I’m concerned.

This really is a great piece to think on and anyone that has younger people they care about should be concerned. But if home values drop so younger generations can afford them, what happens to the homeowners that needed that equity out of their homes for retirement or paying for their parents to be in assisted living?

You could crush one generation in hopes of helping another. Maybe it’s not existing home prices dropping but new homes built are affordable by means of cutting red tape which is what I know my local Association advocates for. Of course if there is not available land to build on, the issue remains.

This is why I say the issue is so difficult, Dionna.

Here’s the thing: if new homes are built, that would necessarily drop the prices of existing homes. It’s simple supply and demand. Whether that happens through changes in local zoning laws, lifting some of the more ridiculous red tape, etc., more new homes = lower prices of existing homes.

What do you do about this? I don’t know. But I do know who ought to be leading the charge in thinking about what to do about it. 🙂

Comments are closed.