One of the biggest changes in the industry as we entered 2018 was a changing of the guard atop the largest real estate company in the U.S. as Richard Smith, CEO of Realogy stepped down, and Ryan Schneider, formerly of Capital One, stepped up. I thought it was all kinds of interesting that Realogy, which more or less defines “traditional brokerage” today, chose someone from outside the industry as its CEO, especially when the other major players like Re/Max and Keller Williams promoted from within.

At the same time, Schneider had been at Realogy as President & COO since October of 2017 and we had seen nothing whatsoever change. I thought perhaps he was brought in to more or less continue the Realogy Way but with a bit more of a focus on finance.

Boy, was I wrong! And I’m happy to have been wrong. (As many of you know, I started my real estate career at Realogy, more or less, so I will always have a bit of a soft spot for the company in my heart.)

Almost immediately upon taking the reins, Schneider has made major changes in personnel, in policy, and in strategic direction. His Q4/2017 earnings call made that pretty clear, and the new direction over in Madison is fascinating. I think there’s real reason for optimism going forward, but I fear that Schneider is going to have to learn some real hard lessons about some of the dysfunction in the industry before he makes course corrections.

For the TL;DR crowd: I think Realogy is going to surprise a lot of people in 2018 and beyond, especially if Schneider and the senior leadership learn quickly and adjust rapidly. Many people have written off Realogy as the giant lumbering dinosaur headed towards extinction, and for good reason. Now, I wonder. I’m getting the sense that something has definitely changed… and for the better if you’re Realogy. Not so much if you’re one of its competitors.

Let’s get into it.

Personnel is Policy

Within the first week of taking over as CEO, Schneider made some big changes in personnel: He then followed up a month later (that’s right, a month) and made even more changes in personnel. Some of the highlights:

- At NRT, longtime leader Bruce Zipf out, and Ryan Gorman, in.

- John Peyton, President and CEO of Realogy Franchise Group, takes over NRT’s Corcoran unit and all of the NRT offices of Sotheby’s.

- Stephen Fraser, SVP and Chief Information Officer, out — Dave Gordon, former CIO at Capital One under Schneider, is in as Chief Technology Officer.

- Kevin Kelleher out at Cartus, an executive search underway.

- Sue Yannacone out at ERA, Simon Chen takes over as President & CEO.

- Fred Schmidt out at Coldwell Banker Commercial; the entire CBC team eliminated and put under the residential brand under Charlie Young.

- Although this was unconnected (probably), can’t leave out that Nick Bailey, formerly of Zillow, took over for Rick Davidson at Century 21.

And these were just the major moves that Realogy bothered to announce. What they didn’t announce, but I heard from friends over there, is that there were hundreds of layoffs/restructurings/firings that went along with these executive changes among the staff ranks. “The list of names was five pages of single-spaced text,” said one contact. Whatever the number, we do know that Schneider reported $50 million in savings from the restructuring. That’s a lot of salaries.

This is important because personnel is policy. Back when Bob Goldberg was appointed as CEO of NAR, I got into a bit of a kerfuffle with then-President Bill Brown because I wrote that Goldberg needed to clean house among the staff at NAR:

He doesn’t have to fire everybody and bring in fresh blood. But senior management, department heads, and maybe a couple of levels under them, need to be looked at very carefully and in all honesty, most of them are going to have to be replaced. Not because they’re bad people or incompetent, but because they’re so used to the way things were under Stinton. You want new thinking and new actions? Get new people, because personnel is policy.

And based on who the new people are, what their track records are, and what they’re all about, we’ll know whether there will be some Change to go along with the Hope of the Goldberg reign.

Bill Brown took exception to that in particular, and talked about how indispensable and hardworking those people are — ignoring the part where I said they’re not bad people or incompetent, merely too used to the way things were under the old regime.

If you want new thinking and new action, get new people.

Schneider got himself a whole bunch of new people to run Realogy, including the key position at CTO, new heads at all of his major business units, and new people to run three of his five brands. And many of them are not real estate franchising or brokerage veterans, starting with Schneider himself. I think that’s hugely significant.

The Earnings Call

Those personnel changes set the backdrop for Schneider’s first earnings call, where he laid out for Wall Street analysts not just the results of operations, but his vision and strategy for where he wants to take the company. I would tell you to read the whole thing, but I realize I’m probably one of a very few geeks in the industry who does that… so you don’t have to.

First, Schneider ticked off a list of competitive advantages at Realogy and why he’s bullish on the company:

- National scale and market share, with 15.9% market share by volume in 2017: “I love starting from a position of scale.”

- Well-known and established brands.

- Technology and data scale, including “a huge portfolio of historical data including robust information on millions of homesale transactions in which we have been involved.” Schneider also said Realogy spends over $200 million on technology every year. That made me do a double-take.

- Powerful financial engine, with $1.5 billion in free cash flow over the past three years, strong balance sheet, and $1.4 billion in revolver capacity.

Having listed competitive advantages, Schneider quickly acknowledged there are problems, saying, “Success for Realogy and our shareholders, however, clearly requires better business results.” He then lays out the strategic vision. It is all kinds of interesting.

Speed

First, and it’s interesting that he mentions this first, is “speed of execution. Realogy will move faster.” Schneider then says that they made leadership changes early on, and executed restructuring. Now, I know he’s telling Wall Street that he’s already moving fast… but a part of me can’t help but think that the message is also for Realogy executives and staff: “Move fast, or else!”

None of us outside of Schneider’s inner sanctum know why certain executive changes were made over there. We don’t know why “hundreds of people” lost their jobs. Could a part of the change have been the perception that those who are out weren’t moving fast enough for Schneider? That he wanted to shake things up, scare the hell out of the people in that building, and send a clear message that a new sheriff is in town, and he expects speed of execution?

Those of us in the industry know that Realogy has long had the reputation of being slow to change. Layers of bureaucracy and decision-making. Gigantic national organization where the field managers really didn’t have a lot of power and authority. Independent brokers and smaller franchising companies talking about how they are just so much more nimble than the big lumbering giant that is Realogy. We all know that’s been the reputation for the past decade or so. “Slow and steady and stable” is the way of Realogy.

Apparently, not anymore. Not under Schneider. Realogy will move faster.

De-emphasizing M&A

Schneider also said that they were going to move away from M&A as an engine of growth. Under the Smith regime, that was the primary way that the NRT (and hence Realogy) achieved growth. And we all knew it, because Smith himself said as much during all of his earnings calls: accretive M&A, or tuck-ins is what he called them.

Under Schneider, that does not look to be the case. He’s going to focus on “organic growth” by which I assume he means recruiting agents, and frankly tells Wall Street to “expect a lower M&A run rate.”

If nothing else, this is significant for the current broker-owners of brokerages of a certain age. Quite a few owners had exit strategies that were one line: “Sell to the NRT.” Hell, I know for a fact that quite a few people joined Realogy franchises with the idea that after a few years, they would sell the company to the NRT. Sort of like the NY Yankees of old, everybody knew that the NRT was always someone you wanted to invite to your sale.

It doesn’t sound like that’s going to be the case anymore. And if the NRT is no longer buying, what does that do to prices of brokerages as acquisition targets?

But those are relatively minor details and “big picture vision” stuff. When Schneider gets into Technology and Agent Commission Rate Economics is when things get all kinds of interesting.

Technology and Data

Schneider sets the table by saying:

Third, we will be enhancing our value proposition for agent by producing new technology and data products. Our goal will be to quickly develop and test products in the market. You should expect to see us disclose our new product releases including beta products and for that to be an increasing part of our conversation of how we drive value for agents and for Realogy.

Yeah, yeah, every real estate company says something like that. Hell, Gary Keller just said Keller Williams is a technology company, not a real estate company.

What’s new and different is that Realogy is taking the exact opposite course from Keller Williams:

And so, I don’t think our future is necessarily going to be different than that, e.g., it’s not going to be a Realogy-only technology solutions get provided. What I think we are going to have to do is make sure we are incredibly easy for agents to both use our technology not just what we have today, but new things that we develop to help make them successful. But also we’re going to have to have an open environment, where it’s incredibly easy to plug in any of the third-party products that an agent wants to use. And that’s really kind of that standard journey from building kind of closed software to using APIs to build much more open and easily integratable software and things like that. That’s an example of a place where I think the industry hasn’t done as much as some other industries. And I think Realogy has room to change in that dimension. And so, that’s likely what we’re going to be doing from a kind of strategic standpoint on that dimension.

And then, we’ve got to take on where can we build great products, whether they’re technology products or data products that we can then deliver to our agents and our franchisees that are going to help them be successful. Those could span a lot of different parts of the value chain. They don’t have to be delivered in a massive integrated system. Many can be delivered on kind of an individual basis and, again, just kind of plugged into the agent’s ecosystem. We’ve got some of those started, but we’ll wait to talk about them when they actually hit the market. [Emphasis added]

Schneider rightly calls out the real estate industry as being behind the curve in openness of software and data access, and lays out a vision where Realogy will use its massive scale to create an “open environment, where it’s incredibly easy to plug in any of the third-party products that an agent wants to use.”

That is a huge change. I don’t think it’s possible to overstate just how big a change this could potentially be.

If Realogy delivers on this, and there’s absolutely zero reason to think it won’t, given the changes in leadership at the top of both the Technology organization and the company as a whole, they really could deliver a “plug-and-play” environment to the developer community and in turn, to their agents.

Just by reducing the friction that software developers face in trying to build products for real estate, Realogy could build the best software/app stack in the industry for its agents. To use just one example, Realogy really could smooth things over with respect to access to MLS data because it is a big Participant in just about every MLS in the country.

Given the above statement, I get the feeling that Realogy won’t be participating actively in something like Project Upstream. Sure, Realogy was never a big fan, even under Richard Smith/Alex Perriello era, but the Schneider/Gordon era emphasizing openness and open APIs strikes me as distinctly unfriendly to the whole “closed universe, control our data at all costs, we have to own everything” type of philosophy that has taken hold in parts of the industry.

I know I can think of several ways that Realogy, with its market power and financial strength, could change the entire technology landscape in real estate. I assume they can too. If not, um, do like Carly Rae Jepsen and call me maybe?

Agent Commissions: No More Giving Away the Store

The biggest change, however, comes in what Schneider has in mind on the agent split issue:

Fourth is our strategy around agent commission rate economics. You have seen our agent commission rates rise substantially over the past 15 months. Where we are subject to competitive market forces, we will use a different approach to this issue in 2018, including providing you greater strategic clarity and the implications of our choices.

The Wall Street analysts try to get Schneider to divulge more, but he resists. He does drop a pretty big hint though in this exchange:

Ryan McKeveny – Zelman & Associates

Thanks, Tony. That’s really helpful. And one on the commission split. So, is the way to think about that, in the sense of the recruiting efforts that have been happening, is it that we should maybe see a step back in terms of some of the things like recruitment bonuses and some of those two or three-year agreements, or is it kind of what you mentioned a shift in the recruiting where if I read kind of between the lines maybe instead of going after for instance one super high producing agent that’s an extremely high split, maybe you get that same volume by recruiting two agents that are slightly lower volume, but in aggregate the same and a lower average split, so any additional color on kind of how that trends to get the moderation in the splits going forward?

Ryan M. Schneider – Realogy Holdings Corp.

Yeah. You know, Ryan, I don’t want to say too much on that one probably just for competitive reasons, but your latter answer is closer to kind of what our thinking is likely to be in the future on that one, and I’ll just leave it at that. [Emphasis mine]

What that means basically is that Realogy (at least the NRT) will no longer be in the running for the elite top producers who demand the world to deign to grace your company with their presence. What it means is that Schneider deeply understands what I just wrote about with respect to the two key numbers for brokerage.

Schneider doesn’t care as much (if at all) about Headcount, Volume, or Transaction Sides as he does about Company Dollar and Profit Margin. That’s a philosophical sea change. If what I’m reading is correct, he’s saying that the NRT would rather have three agents who do 60 deals between the three of them, at a lower split so the company has better margins, than a single super-agent team that does 60 deals and demands 95/5 splits.

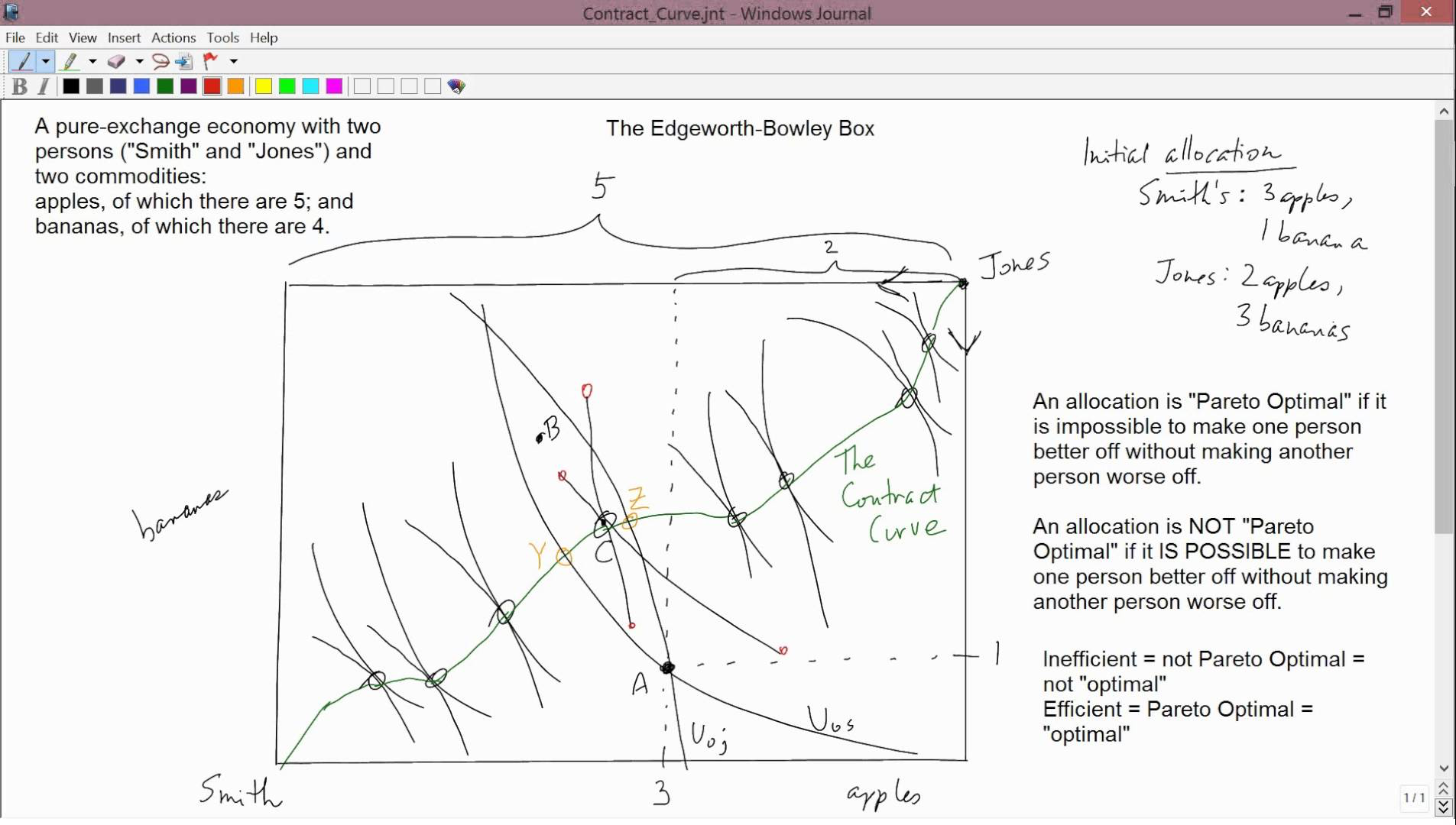

Don’t forget that Ryan Schneider is actually Herr Doktor Ryan Schneider, with a Ph.D. in Economics from Yale University. Which means he deeply understands concepts like pareto efficiency:

It’s not important that you and I might not understand that graph or the math behind it. What is important is that Schneider does. So when he starts thinking about finding the Strong Pareto Optimal point on the production-commission curve….

What it means is that he’s very, very smart. And maybe Schneider is looking at the 4.2% EBITDA margin that the NRT posted in Q3/2017 and going, “Uh, what the hell?” He did mention that the Q1/2018 operating EBITDA will be HALF of what the Q1/2017 EBITDA was, and that a third of that decline comes from “rising agent commission rates.” If you’re going to lose money by recruiting top producers, maybe he’d prefer his competitors recruit them instead and put those losses on their books.

That’s a big shift in thinking among brokers, who are obsessed with numbers that don’t actually matter, like headcount and Sales Volume. Since I’m pushing for and advocating for paying attention to numbers that do matter, getting Ryan Schneider and Ryan Gorman advocating the same thing is a pretty big deal… to me at least.

If the NRT, the largest brokerage in the country, takes this tack going forward, it will have enormous ripple effects throughout the industry.

What He’s Missing, and Course Corrections

So on the whole, I think what Schneider is laying out is incredibly positive for Realogy. But he’s going to run into some unexpected headwinds from the dysfunction in the industry. I expect that he will need to make some course corrections, and given the emphasis on speed, I suspect that Schneider and Realogy will make those corrections pretty quickly.

First, I think Schneider might not be prepared for the depth of problems related to the 1099 Independent Contractor issue in real estate. Coming from the banking/finance world as he does, I don’t know that he knows the extent to which that single factor complicates everything.

I could be wrong, since he has been at Realogy since October of last year, and I’m sure has heard from all of the experienced executives from Richard Smith on down. But I know I didn’t realize the extent of the problem for years in the industry, so I suspect he doesn’t fully realize just how problematic it is yet.

Second, nothing I have heard from brokers and agents in the field (reminder: I’m married to a former CB broker) convinces me that his optimism in the Zap platform is warranted. In the call, Schneider, Tony Hull (CFO of Realogy), and an analyst kind of discuss the technology strategy and Hull mentions Zap:

Ryan, the one thing I would just supplement Ryan’s answer with, because I think you raised a really good point in your question, which is it’s one thing to do it with your owned brokerage and really influence the agent’s productivity, and it’s a whole another challenge to when you’re going through a franchise network to, A, get the franchisees to change, and then affect that change with their agents. So, I think that’s something our competitors sort of they’re out there is, oh, we’ll just do this, that and the other thing, and it’ll magically happen.

It’s not easy and we have like a three-year head start on anybody on doing that through our Zap rollout. And we’ve had so many learnings from that that I just think we’re much better prepared to – when you sort of – we’re effectively a third party trying to influence our franchisees and then their agents. I think, we’re much better at that now than any of our competitors. So, we have a lot of experience in that area.

Well, if they have a lot of experience in that area, then I don’t know where this confidence comes from. I realize that the instinct amongst Realogy folks is to get defensive and start talking about how wonderful Zap is, given the huge investment Realogy made, and the huge emphasis on it, but Schneider and team really need to resist being defensive and try to get real honest feedback from the field.

Frankly, that might require Schneider hitting the road and going and talking to branch office managers and agents without them worrying about saying the wrong thing to the boss or whatever, but as an outsider, but someone who talks to a lot of brokers and agents, I have yet to hear anybody say wonderful things about Zap… unless his or her job is to say wonderful things about Zap.

Third, Realogy is a monster real estate company, no doubt. But the real estate industry is a complex web, and not even Realogy can do whatever it wants without upsetting balances of power, existing structures, the intertwined web of interests and alliances and rivalries and so on and so forth. I think Schneider and team will need to be very, very nimble in negotiating all of that.

Realogy the Change Agent?

Having said all that, on balance, I think the Schneider Era is off to a very good start. Most of the top leadership at Realogy is now comprised of relative newcomers to real estate. You could say that’s bad, because they don’t see some of the pitfalls, but I think it’s good on balance, because they don’t have decades of pre-existing notions of what works and doesn’t work. A lot of the executives do not have personal investment in some of the major initiatives of the past, and can jettison what doesn’t work without worrying about internal politics or boardroom fights.

In that context, I can’t help but compare Realogy with some of its main competitors. Keller Williams has a new CEO in John Davis, but he’s been with the company for decades, and as we saw in the recent Family Reunion, everyone knows Davis doesn’t set the strategic vision for KW — Gary Keller does. Re/Max has a new sole CEO in Adam Contos after months of weirdness and board investigations and such, but again, he’s an internal candidate with years and years of experience at Re/Max alone. We haven’t seen the kind of “personnel is policy” housecleaning at any of those companies that we’ve just seen at Realogy. HomeServices of America certainly hasn’t made major changes in its executive suite. Howard Hanna hasn’t and won’t, being an old family business. And so on down the line we go.

It feels odd suggesting that the standard bearer for the old guard traditional brokerage might be the revolutionary in our midst… but that’s exactly where we are. Realogy, of all of the real estate companies, might be that Change Agent for brokerage because of new leadership at the top driving changes down throughout the organization.

Ain’t that something? Whodathunkit? But here we are, and I for one look forward to future earnings calls from Ryan Schneider and crew at the revitalized, re-engineered Realogy.

-rsh

17 thoughts on “Realogy Enters the Schneider Era: Thoughts from the 2017 Earnings Call”

Great stuff Rob. Let’s hope we really are seeing the beginnings of desperately needed change in our industry–it is beyond overdue. And yes, you have consistently nailed this point: it is only by focusing on the numbers that actually matter that new business models can be developed (and whoever finally does that is going to change the rules of the game for everyone).

Of course, as you note, far too many are mired in old ways that simply do not work anymore, which is leading to huge waste and the most deplorable inefficiency, but that also means there is an astounding amount of opportunity out there. I’m happy for Realogy or any of its brands or anyone else taking leadership in impelling evolution. For God’s sake let’s figure out tomorrow. Yesterday is broken.

Well written piece Rob. The fact they’re also not confused about whether they are a tech company or real estate brokerage/enterprise and thus taking the opposite route of Big Red is not lost on many of us. What is not mentioned and is a big driver of margin, EBIDTA etc overtime is agent turnover.

If you’re running the largest national brokerage and running at 34-36% agent turnover, this is a huge headwind for you and likely more impactful on Company Dollar and margin than splits. Turnover tends to be significantly higher the farther you move down the food chain in terms of production. As such, a company with higher producers, say 80+ percent of roster in production and producing company dollar (and turnover rates closer to (8-11%) will produce better margin than even the mammoth larger ones who are constantly treading water to replace their lower split roster participants.

Ask yourself this question. If 100K agents (who are mid-higher producers) change brokerages in the next 3-4 years, does the brokerage who ends up with the lions share of these agents (read lowest turnover) win?

It seems that recruiting and training for the “happy middle” re agent production is more profitable. But traditional brokerage is ego based and thus ‘top line gets headline.’ The happy middle is far less demanding and would arguably also happily pay better than a paltry split in exchange for stronger, quality support. In turn you get loyalty and margin. Easier on everyone but requires dedication, a passion for quality, and policy depth, top down. Not as sexy but not everyone thinks profit is sexy in this crazy industry.

Agree with all that, but aren’t the top producers the social proof other agents/brokers need to join a brokerage? So if Realogy doesn’t cater to / care about those agents anymore, it seems that will be a trickle down effect that will make recruiting harder.

I agree with you 100% Drew.

This and what Drew said below is exactly what I was thinking reading this article. I’ve witnessed it many times and unless every other company adopts the same philosophy on splits, it won’t equate to higher company dollar.

Another awesome post! You rock!

As another ex-Realogy executive, I too, have a soft-spot for Realogy. All these changes were necessary for a variety of reasons. Painful, I know, I am getting calls from lots of people, but necessary.

I believe bringing in outsiders with fresh ideas is the way to go.

I think all of those people will land on their feet, in places where their deep experience will help drive their new employers to greater success. Many, if not most, are great people, great assets. But like I said, I think Schneider wanted a new direction, and the only way to get that is with new people….

Very interesting Rob as usual

The single biggest challenge for Realogy and the traditional franchises and single real estate brokerage it owns? “Random real estate.” The value of the “undocumented processes of ICs” is diminishing quickly with the consumer and the ability for Realogy to slow the pace of that errorsion will need to be very substantial. Ryan has inherited a plethora of old tired brands whose power has been greatly diminished with the consumer and a collection of conversion franchises that will be next to impossible to now format and change. As he restructures he had better be recruiting experienced architects and super salespeople – those that clearly know what must be done now for brokerage to survive the growing consumer intolerance for traditional brokerage and are able to sell that strategy to those that will now agree that they must change in order to make it happen. This is an extremely tall order, that is for sure.

Great piece Realogy is kind of like a slumbering giant that just got a shot of adrenaline. And I do think that, from what I have heard, they recognize the limitations of Zap — and they don’t have any personal sunk costs into that because it was acquired under the prior regime, so they won’t have a “sacred cow” approach to it. As a Realogy franchisee, I think what they’re doing is really energizing.

As a Coldwell Banker NRT agent that has typically been in the upper echelon of agents individually(pre-team acknowledgment) or as I am now as part of a top producing group, I hope they recognize that in order to maintain and grow market share you need the balance of the “elite” as you call them, along with the more profitable mid producers. Good agents continue to grow their business and there has to be incentive to entice them to stay with the brand. The “elite” also attract the more profitable newer agents along with the mid- producers. Discontinuing to attract and service the “elite” impacts market share. When you impact market share you damage the brand. It’s an industry where who has the listings controls the market which is a small percentage. There is not a clear profit margin line on who adds to your bottom line and who doesn’t as in other industries.

My hope is that they will continue to find value in myself and my group. I am excited for the change in leadership at NRT. Both myself an the head of my group, were at CB NRT, left and found the grass was not bluer at another franchise and returned. Besides my region’s president, who I treasure, I really don’t know anyone at NRT. I do know many of the people at Coldwell Banker Corporate in NJ and feel they are the best and brightest in our industry. Many of Mr. Schneider’s changes that you have noted are within NRT. As a CB NRT agent, I hope the new NRT leadership incorporates more of the brilliance that the brand offers.

I can’t speak to Zap since as an NRT agent I still have no access to it.

Great article, I don’t know if she didn’t want the job or wasn’t offered the opportunity but from the outside looking in Pam Leibman should be running NRT. The success at Corcoran is all the proof one needs. Too bad, as a female in that position would have been good for Realogy not to mention one of the most accomplished people in the company.

Comments are closed.